Chaos Theory and the Stock Market

Are markets random in nature?

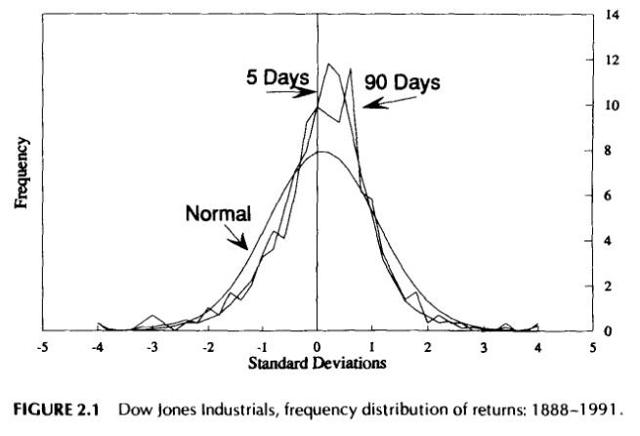

Neoclassical economists have introduced theories such as the efficient market hypothesis and random walk theory that led to the contemporary passive investing boom. If the stock market returns were indeed random, they would follow a normal distribution. Trader turned author Nassim Taleb calls the application of the bell curve to financial markets “that great intellectual fraud,” and for good reason too. Firstly, the application of a normal distribution and its implied mean, variance, and standard deviation has had disastrous consequences because normal distributions underestimate actual risk in markets. Portfolio insurance in 1987 amplified that year’s flash crash and the implosion of the highly leveraged Long Term Capital Management in 1998 nearly crippled the global financial system. Both relied on underestimated standard deviation as a measure of risk.Secondly, empirical evidence shows that stock market returns do not follow a normal distribution. The figure below shows the 5 day and 90 day frequency distribution of returns of the DJIA from 1888-2001. Even though the data set ends in 2001, it contains the most points to analyze. Notice the distribution has a higher peak at the mean and fatter tails than a normal distribution. This is statistically significant. As author Edgar E. Peters argues in his book, Fractal Market Analysis, a normal distribution implies that the risk of a standard deviation event of greater than three is 0.5%. Historically, based on the data below, the probability is nearly five times that at 2.4% (Fractal Market Analysis, p. 26).

(Source: Fractal Market Analysis, p. 21)

(Source: Fractal Market Analysis, p. 21)Black noise

Peters provides an alternative way to think about the nature of markets. Physicists use colors to describe differences in power spectrums of noise signals, with the flat distribution of white noise being the most well-known. High peaks at the mean and fat tails is comparable to black noise. Black noise is predominantly zero (silence) interrupted by unpredictable noise spikes. This makes intuitive sense. The upswing of an economic cycle provides steady returns until fundamental weakness and an exogenous shock trigger a panic. The nature of the market is nonperiodic cycles of growth and sharp downturn.The stock market is a complex system because it has multiple actors with multiple objectives. Day traders with investment horizons measured in minutes buy and sell the same securities as pension funds with investment horizons measured in years. Short term traders provide constant liquidity while long term investors provide a back stop to markets by intervening to buy when prices drop. When the long-term outlook becomes particularly bleak, long-term investors do not step in to stop stock prices from falling, amplifying market downturns and making them multi-standard deviation events.

Where does chaos theory fit in?

The market has characteristics of deterministic chaos – randomness at the local level with daily price fluctuations and nonperiodic crashes, but order at the global level through upward trending cyclicality. Additionally, markets are sensitive to initial conditions because they determine the depth and duration of crash.The seeds of a bear market are sewn in the previous bull market. I posit that these seeds tend to be macro (business cycle, geopolitics, etc.), social (euphoria), technical (market structure), or a mixture of the three. To illustrate an example of each, the 1987 flash crash is largely attributed to changes in market structure as prices hit levels that caused computerized trading programs to sell simultaneously. 1997 saw macro contagion from an Asian currency crisis and 2001 is mostly attributed to technology stock euphoria.

Today's market

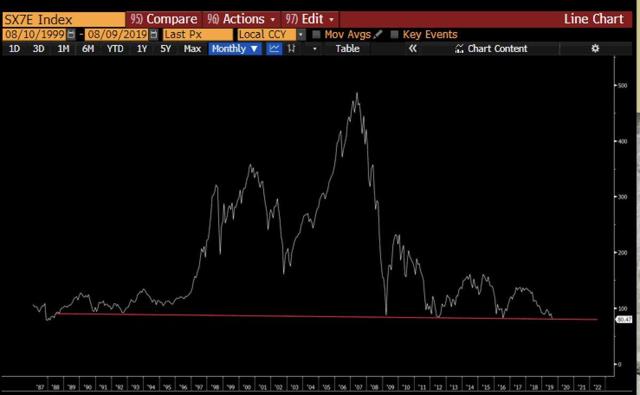

What are the initial conditions today that can affect future stock market returns? Since I’ve already thrown rocks at the Neoclassical school of economics, I would be remiss to leave out the Keynesian school. Unprecedented monetary policy is the first initial condition that did not exist in previous market cycles.The first example that comes to mind is negative interest rates in Europe and Japan. Low interest rates squeeze profit margins of banks because they get paid reduced interest on loans. Now imagine paying an individual or corporation to take out a loan, the essence of negative interest rates. The chart below of the Euro Stoxx bank index demonstrates how a policy of low to negative rates has crushed profitability of banks. The contagion of European bank failures would be immense.

(Source: RaoulGMI)

(Source: RaoulGMI)On the same token, the global economy currently has $17 trillion of negative yielding bonds. These assets are guaranteed to lose the investor money. While some might purchase these bonds to hedge currency risk or to speculate on more negative rates, negative yielding bonds should be a boon for gold prices. Unlike stock dividends, growth, or positive bond yields, gold is a non-yielding asset that exists as an alternate store of value. A non-yielding asset is better than a negative yielding asset, and a portion of the market that existed for European and Japanese bonds should see gold and potentially Bitcoin as a better alternative.

Another unseen initial condition is the advent of crypto-currency. With a global environment of anti-globalization and heightened nationalism, crypto provides an alternative to the dollar that nations attempting de-dollarization did not have before. Russia, China, Iran, and Turkey have all publicly demonstrated interest in state-backed crypto. Be on the lookout for countries experimenting with creating crypto-currencies as alternatives to the dollar based system and the effects this will have on markets the global financial system.

Conclusion

This article is admittedly highly theoretical with few implications to retail investor portfolio management. This article offers a different way to think about the market based on evidence of the market as a chaotic system. High standard deviation events are a staple of the stock market, making uncorrelated diversification and tail risk hedging necessary. Investors usually forget this fact and become complacent due to high peak at the mean in the frequency distribution of returns.Additionally, chaotic systems are highly dependent on initial conditions. What we have today is a set of unprecedented initial conditions with unknown effects. With capital preservation being the first principle of investing, I preach caution and hedging risk above all else in today’s market.

Comments

Post a Comment